About Differentiated Solutions

Tailored Financial Strategies Designed to Help You Capitalize on Opportunities

Our seasoned team blends business-savvy, insurance mastery, and actuarial insight to design bespoke solutions for your financial, family, and business goals. We navigate the complexities of regulations and finance to craft a personalized, intentional plan that addresses your unique needs. Our expertise has helped to create innovative solutions that cater to high net worth individuals and focus on estate and succession planning. Access customized insurance and financial products, modeled and structured to overcome your challenges and capitalize on opportunities.

OUR Solutions

We simplify complex financial challenges:

→ Fund debts, family income needs, and taxes at time of death or disability.

→ Fund buy/sell agreements.

→ Provide peace of mind through enhanced medical care.

→ Provide income security at retirement.

→ Provide secure investment alternatives.

→ Facilitate the transfer of wealth between generations.

Why Us?

See our difference for yourself:

| Traditional Financial Advisor | Differentiated Solutions | |

|---|---|---|

| Approach to Planning | One-size-fits-all | Tailored and Bespoke |

| Expertise | Standard Financial Knowledge | Actuarial Insight and Technology |

| Customization | Limited Options and Flexibility | Comprehensive and Personalized |

| Investment Strategy | Conventional Investment Approach | Holistic and Diversified |

| Client Engagement | Directive and Transactional | Collaborative and Transparent |

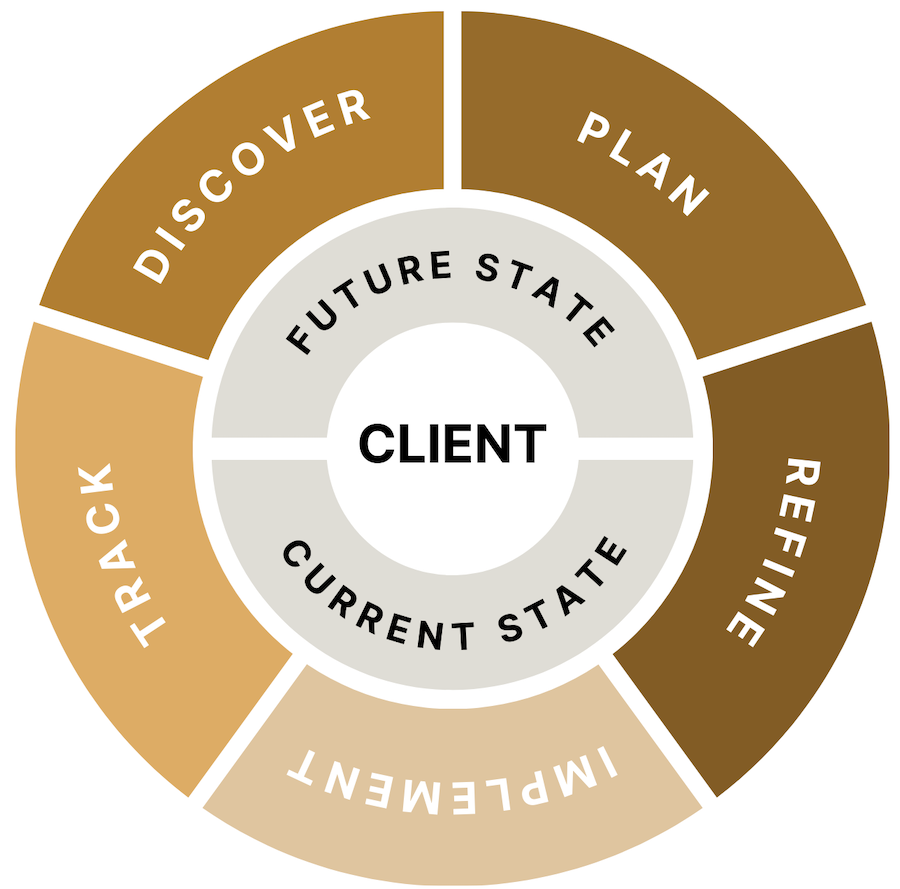

Our process

- At A Glance

- 1. Discover

- 2. Plan

- 3. Refine

- 4. Implement

- 5. Track & Optimize

A seamless, customer-centric process at every step.

At Differentiated Solutions, you will have an experience far beyond what other financial advisors offer. We start by understanding your current and anticipated circumstances and your goals. We then share our experiences and discuss solutions other advisors likely would not propose. Our difference is further amplified by our proprietary software, which provides real-time transparency into the drivers that affect the outcome and shows the detailed benefits of our solutions. Our process is purposely designed to provide confidence, transparency, and understanding so you know that you have the best solution!

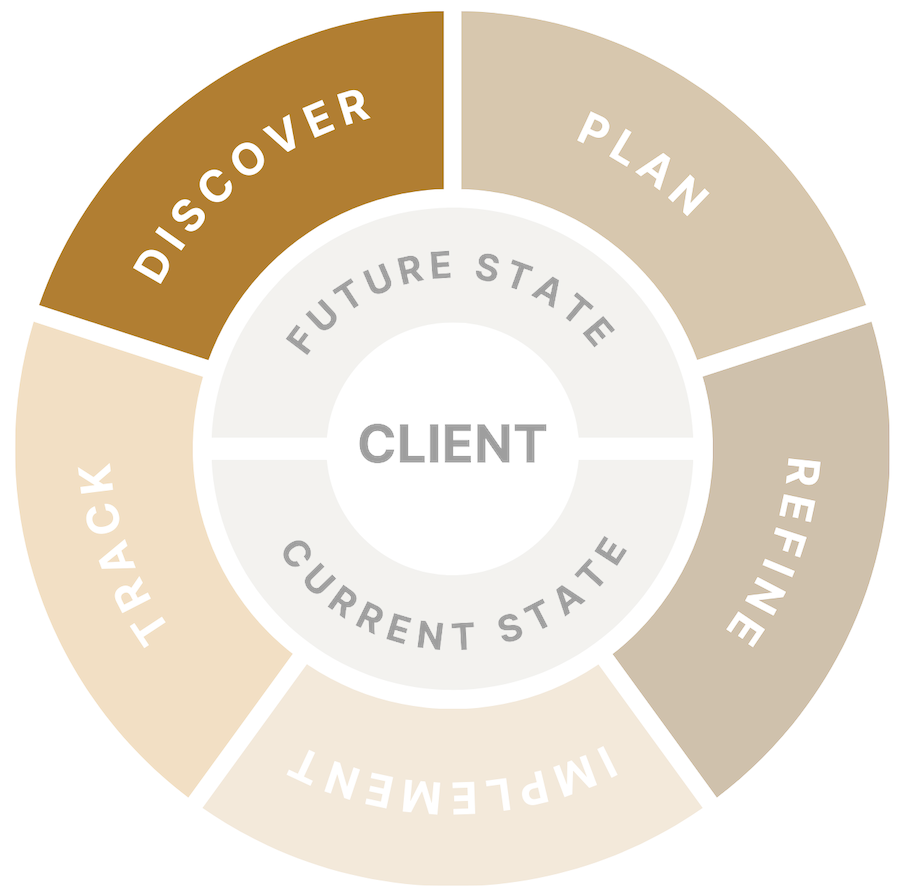

Step 1

Discover

In our initial meeting, we delve deep into your unique circumstances and aspirations, covering family, finances and future goals, including business support, debt management, education funding and wealth transfer. Our comprehensive approach, enhanced by our expansive insurance solutions, sets us apart.

Step 2

Plan

In this phase, you will benefit from of our unique client service approach. We craft a custom insurance plan using insights from the DISCOVER phase, avoiding one-size-fits-all answers. With our software, we analyze options annually against your criteria, selecting the optimal solution with tools and skills unmatched by competitors.

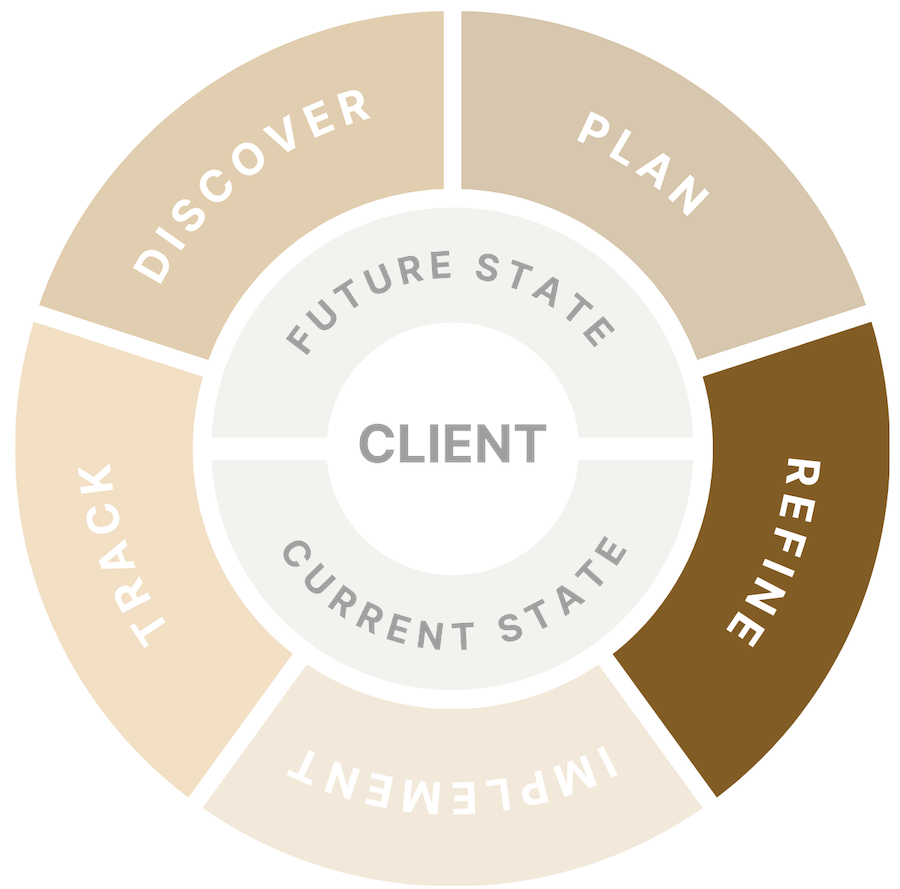

Step 3

Refine

In this phase, we collaborate closely with you to refine the tailored insurance solution developed in the PLAN phase. Understanding that prioritization or compromises may be necessary, we leverage our software for real-time adjustments and detailed comparisons based on your specific criteria. A real-time comparative analysis tool will help you quickly compare alternatives, get the best answer tailored to your unique situation, and educate you on the impact of the various alternatives.

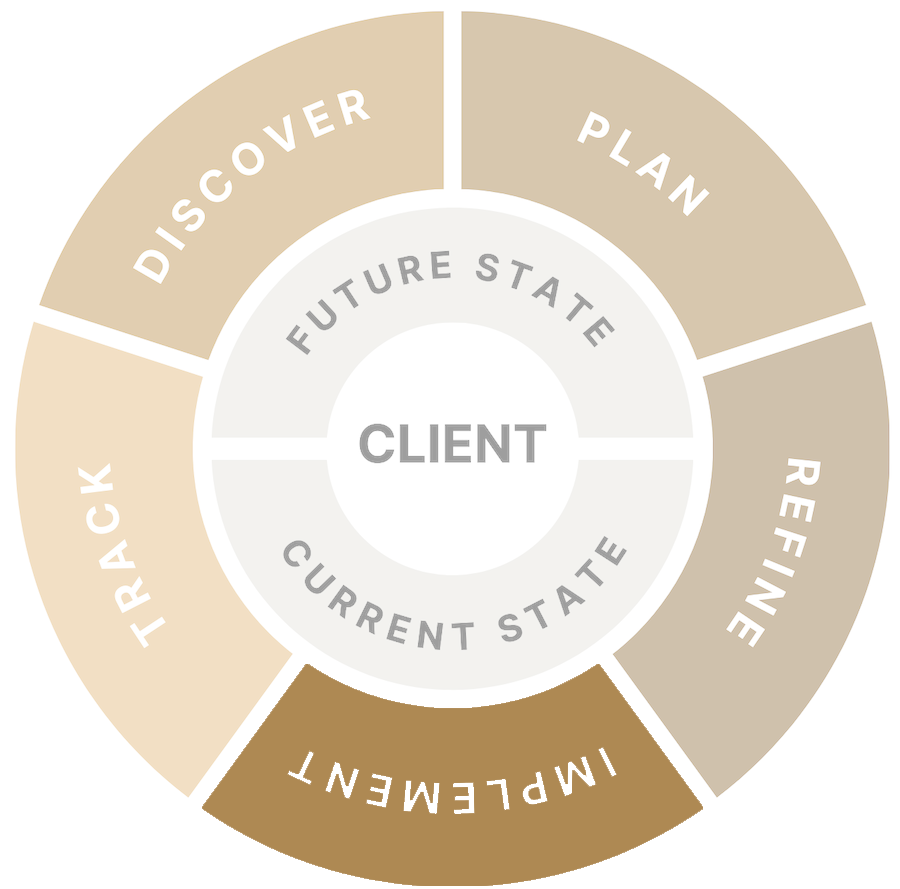

Step 4

Implement

In the implementation phase, we prioritize transparency and clear communication from start to finish. We work to ensure your journey is smooth and understandable and that you feel informed throughout.

Step 5

Track & Optimize

In this phase, we conduct two reviews annually: Using our proprietary software, we review your insurance's actual versus modeled performance, highlighting any differences due to various factors (which can include morbidity, mortality, interest rates, and the future impact of the differences), and we identify any changes from the DISCOVER phase and resolve it with you. This unmatched approach keeps you informed and enables annual adjustments to your plan, ensuring it always meets your needs.

What our clients are saying

"Joel’s responsiveness and analytical ability are truly second to none, and when combined with his moral compass, which is beyond reproach, Joel stands alone, far above his competitors."

Jason W

What our clients are saying

"Joel's proprietary software allowed us to compare the financial implications of all the options more easily and updated calculations and numbers quickly when scenarios or factors changed."

Arnie and Elizabeth B

What our clients are saying

"Joel's modeling software was helpful in comparing different scenarios and helping us objectively pick the option that best fit our needs."

Jeffrey and Lesley C

What our clients are saying

"Joel's knowledge and customer service are unparalleled in the industry. He designed a solution customized to our needs that allows us to change payments over time to adapt to unexpected changes."

Arnie and Elizabeth B